[ad_1]

Irrespective of if it’s 2014 or 2024, relating to crypto, Bitcoin has at all times been and can probably at all times be the primary cryptocurrency individuals consider. Particularly throughout instances when the crypto market goes up — lots of people begin getting FOMO and pondering, ‘What if I invested $100 in Bitcoin 1, 5, 10 years in the past?’

Whether or not you wish to construct a diversified portfolio with Bitcoin as one of many dangerous belongings or just top off on the world’s largest cryptocurrency and (presumably) make a fast buck, it may be helpful to know spend money on BTC. On this article, I’ll discuss it as an asset, the methods to spend money on Bitcoin, and attempt to reply the query, “What if I make investments $100 in Bitcoin right now?”

Key Takeaways: The best way to Spend money on Bitcoin

Bitcoin is the world’s largest cryptocurrency, and its worth is pushed by quite a lot of components, like shortage and potential for prime returns.

Investing $100 in Bitcoin may be worthwhile so long as you do it on the proper time or make common investments.

Investing in Bitcoin affords excessive potential returns, liquidity, the prospect of being on the forefront of digital foreign money evolution, and a hedge towards inflation because of its capped provide.

Nonetheless, dangers embody worth volatility, a scarcity of regulatory framework, susceptibility to digital threats, and the absence of assured returns.

If you wish to spend money on Bitcoin, you will want a safe crypto pockets, a good cryptocurrency change, and a fee technique, be it fiat cash or one other crypto asset.

What Is Bitcoin?

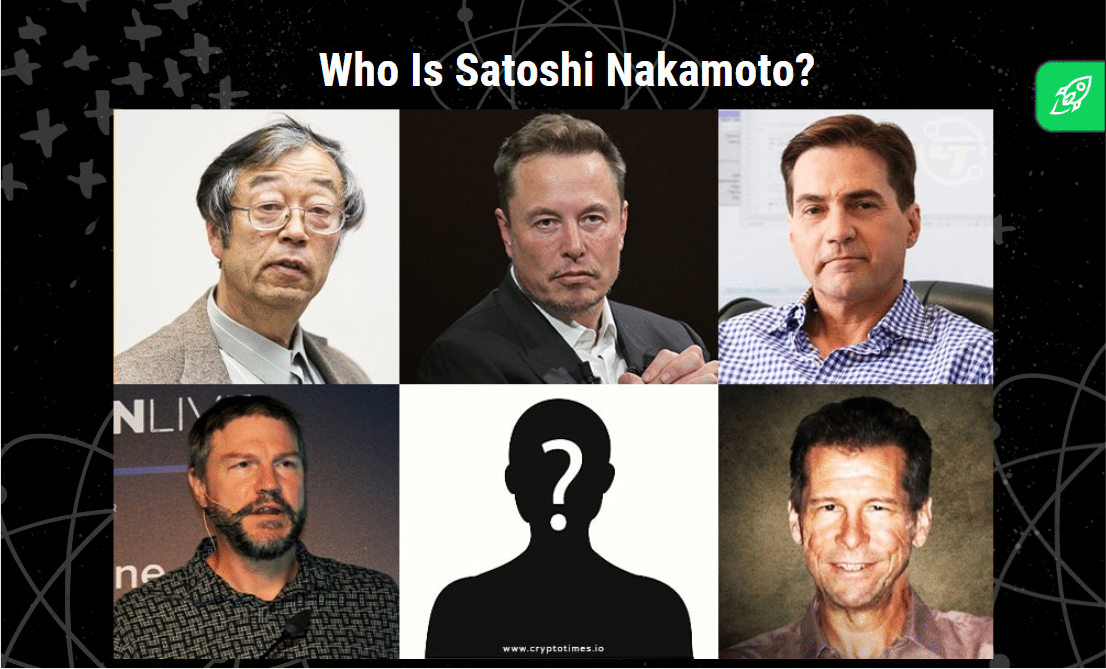

Bitcoin, typically denoted as BTC, is a digital or digital foreign money. It’s like an internet model of money that was invented in 2008 by an unknown particular person or a gaggle of people that used the identify “Satoshi Nakamoto.” Bitcoin began as a paper printed on the web, outlining the idea of a “peer-to-peer digital money system.”

The creation of Bitcoin delivered to life the thought of cryptocurrency. In easy phrases, a cryptocurrency is a decentralized type of foreign money, present totally on-line, that makes use of cryptography — a technique of defending data by remodeling it into an unreadable format, often called encryption — for safety.

In contrast to conventional currencies, such because the greenback or euro, that are managed by central banks, Bitcoin operates on a decentralized community of computer systems unfold world wide. This decentralization means no single establishment controls the Bitcoin community. It’s a democratic type of cash, so to talk, managed by the individuals who use it.

How A lot Does It Value to Purchase Bitcoin?

Right here’s the present worth of Bitcoin.

Questioning what’s going to occur for those who make investments $100 in Bitcoin right now? Take a look at our Bitcoin worth prediction to see how BTC worth may behave sooner or later.

How Does Bitcoin Work?

On the coronary heart of Bitcoin is a public ledger referred to as a blockchain. This ledger incorporates each transaction processed, permitting the person’s laptop to confirm the validity of every transaction. This entire transparency helps keep the integrity of the system.

Folks often called miners use highly effective computer systems to resolve complicated mathematical issues that validate every Bitcoin transaction. As soon as an issue is solved, a transaction is added to the blockchain, and a miner is rewarded with a small quantity of Bitcoin. This course of is named Bitcoin mining.

In contrast to a standard checking account, a Bitcoin pockets requires no paperwork. A Bitcoin pockets may be arrange in minutes out of your laptop or smartphone. You’ll be able to obtain Bitcoins in your digital pockets from anybody else who has a pockets. Each transaction made with Bitcoin is saved within the blockchain.

Bitcoin Halving

Roughly each 4 years, the reward for mining Bitcoin transactions is halved, decreasing the provision of recent Bitcoins getting into circulation. This occasion isn’t just a technical adjustment however a big milestone that usually results in anticipation and hypothesis inside the cryptocurrency neighborhood.

Traditionally, halvings have been related to durations of worth will increase, because the decreased tempo of recent provide can result in upward stress on costs, assuming demand stays fixed or will increase. This phenomenon underscores Bitcoin’s deflationary nature, designed to imitate the shortage and worth preservation much like valuable metals like gold.

You’ll be able to study extra about Bitcoin halving right here.

What Makes Bitcoin Beneficial?

There are just a few key explanation why Bitcoin is efficacious.

Shortage. The whole variety of Bitcoin that may ever exist is restricted to 21 million. This synthetic shortage is coded into the Bitcoin algorithm.

Decentralization. Bitcoin isn’t ruled by a government, like a authorities or a monetary establishment. Its worth can’t be manipulated by these entities.

Utility. Bitcoin transactions can happen between events with out a intermediary, comparable to a financial institution. These transactions are usually processed sooner and with decrease charges than transactions of conventional banking techniques or cash switch companies.

Potential for prime returns. Bitcoin’s worth has traditionally seen excessive ranges of volatility. This volatility creates the potential for prime returns, although it additionally will increase danger.

Anonymity and privateness. Whereas all transactions may be traced utilizing blockchain know-how, the identities of individuals concerned in transactions aren’t disclosed.

Bitcoin’s worth isn’t inherent, as with gold or oil. In reality, it comes from the idea and settlement of its customers and merchants. That is true for all types of foreign money. What units Bitcoin aside is its mix of shortage, utility, and independence from conventional financial techniques, making it a novel monetary phenomenon.

Because of this, nevertheless, it may be arduous to foretell Bitcoin’s worth, and very often, it finally ends up being dependent so much on the overall perspective of the market. As we have now seen earlier than, many Bitcoin holders are vulnerable to panic and have “weak fingers,” which means they have an inclination to dump their cash when the BTC worth begins to say no, driving the whole worth of the asset decrease.

Is It Price Investing in Bitcoin Right this moment? Or What Will Occur If You Make investments $100 in BTC Proper Now

Let’s think about that you simply determined to speculate $100 in Bitcoin proper this second. What can occur to your funding? Can you continue to make an enormous revenue?

Effectively, if that is your absolute first time investing in Bitcoin, you may need to attend some time for this funding to repay — particularly for those who purchase Bitcoin on the top of a rally. If you wish to take advantage of out of a singular $100 Bitcoin funding, it might be extra worthwhile to attend for a second when its worth is comparatively low. On the identical time, you may nonetheless make investments $100 in Bitcoin even on the top of a rally and nonetheless get a revenue — however it received’t be that large.

Nonetheless, if you have already got Bitcoin in your funding portfolio, including $100 extra value of BTC to it may show to be very worthwhile in the long term. Right here’s an instance.

Throughout its rally in 2021, Bitcoin hit its earlier all-time excessive of $69K. Let’s think about you had purchased some BTC not on the absolute peak, however when it was $65K. On the time, $100 value of Bitcoin would’ve been equal to round 0,0015 BTC. Should you had then waited and bought that Bitcoin in March 2024, when it hit $70K, you would’ve bought it for $105… A small revenue, and that’s with out taking inflation under consideration. Nonetheless, for those who had additionally purchased Bitcoin for $100 when it was $20K, and $30K, your revenue would’ve been method greater.

The Dangers and Advantages of Investing in BTC

Earlier than wanting on the dangers and advantages of investing in Bitcoin, you need to first decide whether or not it’s even value it so that you can spend money on BTC — or every other crypto in any respect.

Many individuals get sucked into making crypto investments out of FOMO, which frequently results in nothing however losses. Earlier than becoming a member of the ranks of crypto traders, ask your self the next questions:

Why didn’t I purchase Bitcoin earlier when it was cheaper?

Why am I shopping for it — to hodl or to make a fast buck?

If it’s the latter, then why do I believe I will promote it later at a better worth?

Do I perceive what Bitcoin and the crypto market are?

Am I OK with the chance? Can I afford to lose all the cash that I’m going to spend money on Bitcoin?

Your solutions to those questions will provide help to perceive whether or not you need to spend money on Bitcoin or not.

I might personally advise towards getting into the Bitcoin markets and crypto market typically in case you are weak to playing. The character of the cryptocurrency is speculative to a excessive diploma, presenting a high-risk, high-reward dynamic that may doubtlessly hurt individuals vulnerable to playing addictions. Please keep in mind to watch out and keep away from making monetary selections that may trigger you to lose all of your funds — or, worse, go into debt.

Now, let’s check out the precise dangers and advantages of investing in Bitcoin.

Advantages of Investing in Bitcoin

Excessive potential returns. In comparison with conventional investments, such because the inventory market, Bitcoin and different crypto belongings have proven a considerably greater potential for returns.

Liquidity. Bitcoin buying and selling happens 24/7 on varied cryptocurrency exchanges, offering excessive liquidity and the flexibility to commerce at any time.

Way forward for foreign money. Many consider that digital foreign money is the long run, and investing in Bitcoin now might yield important returns as digital currencies turn out to be extra extensively adopted.

Inflation hedge. With its provide capped at 21 million, Bitcoin might act as a hedge towards fiat foreign money inflation.

Dangers of Investing in Bitcoin

Value volatility. Bitcoin is thought for its worth volatility. The value can fluctuate extensively in a brief interval, which might result in important losses.

Lack of laws. The crypto market remains to be comparatively new and lacks the regulatory framework of conventional monetary markets.

Digital threats. As a digital asset, Bitcoin is inclined to hacking, technical glitches, and different cybersecurity threats.

No assured return. As with every funding, there’s no assured return. The worth of Bitcoin is very depending on demand, and if demand falls, the worth might plummet.

What You Will Must Spend money on Bitcoin

To start your cryptocurrency funding journey, you’ll first want just a few issues:

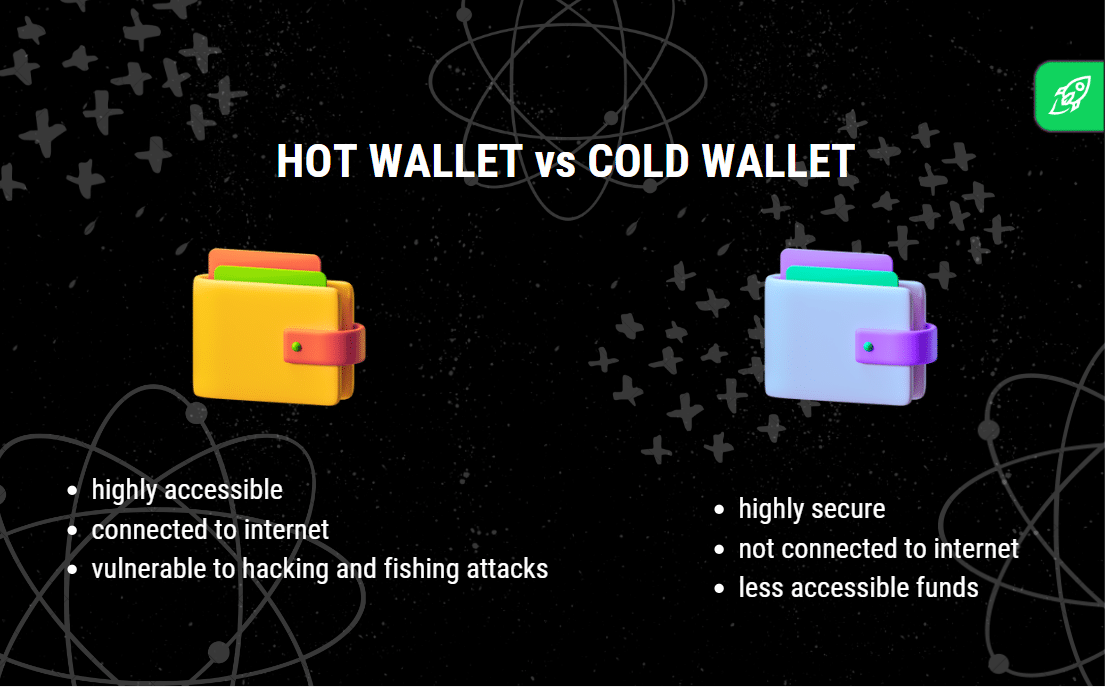

Crypto pockets. To retailer your Bitcoin holdings, you’ll want a {hardware} or a sizzling pockets.

Appropriate crypto change. You’ll have to discover a cryptocurrency change the place you may safely and securely purchase and promote Bitcoin.

Cost Methodology. Most main exchanges settle for totally different fee strategies, together with financial institution transfers, bank card funds, and even different cryptocurrencies.

Threat tolerance. Crypto investments are risky belongings, and investing in them carries danger. Guarantee you have got a transparent understanding of your danger tolerance earlier than you start.

Scorching vs. Chilly Wallets

On the subject of storing your Bitcoin, you have got two choices: sizzling wallets and chilly wallets.

A sizzling pockets is related to the Web; that’s why it permits you to simply entry your Bitcoin to conduct transactions. Nonetheless, the sort of pockets is weak to on-line threats. Some good sizzling wallets are Exodus, ZenGo, and Jaxx Liberty.

A chilly pockets, also called a {hardware} pockets, is a bodily gadget not related to the web, offering an additional layer of safety. Chilly wallets are a sensible choice for those who plan to carry Bitcoin as a long-term funding, although they may not be as handy for frequent buying and selling or transactions. Should you’re on the lookout for a dependable offline pockets, you will get Trezor or Ledger.

Whichever sort of crypto pockets you go for, be sure to by no means share your keys with anybody.

The Greatest Crypto Exchanges For Learners

Choosing the proper crypto change is essential. Listed below are just a few of one of the best cryptocurrency exchanges for rookies:

Coinbase. Identified for its user-friendly interface, Coinbase is a good platform for novice customers. It affords all kinds of cryptocurrencies for buying and selling.

Binance. With one of many largest picks of digital currencies, Binance is an effective alternative for these seeking to discover past Bitcoin.

Changelly. Changelly is a good platform for crypto rookies — it has an intuitive, user-friendly interface and supplies customers with free guides on all issues crypto. Changelly’s fiat-to-crypto market aggregates affords from all kinds of suppliers, guaranteeing you received’t need to scour the web for one of the best Bitcoin costs.

When selecting an change, components comparable to safety features, buying and selling charges, and out there cryptocurrencies are value consideration. All platforms supply their very own distinctive advantages, so it could possibly be helpful to strive just a few of them out first with smaller quantities.

Greatest Methods to Spend money on Bitcoin

Investing in Bitcoin may be completed each immediately and not directly, and every technique fits totally different investor profiles and carries its personal dangers.

Direct Funding:

Buying Bitcoin: Shopping for and holding Bitcoin is probably the most direct technique. It fits these snug with dealing with digital belongings however includes dangers associated to Bitcoin’s worth volatility and the safety of digital wallets.

Buying and selling Bitcoin: Participating in shopping for and promoting Bitcoin on exchanges. Appropriate for individuals who are skilled in buying and selling and perceive market traits. The danger lies in market volatility.

Greenback-Value Averaging (DCA): Investing a set quantity into Bitcoin at common intervals. It’s preferrred for long-term traders seeking to mitigate the influence of volatility.

Oblique Funding:

Bitcoin ETFs: Alternate-traded funds that monitor Bitcoin’s worth, permitting funding with out proudly owning Bitcoin immediately. They’re handy for conventional traders however might contain administration charges and don’t present precise Bitcoin possession.

Bitcoin-Associated Firms: Investing in corporations which might be concerned within the Bitcoin ecosystem. This technique supplies oblique publicity to Bitcoin’s efficiency with the added dangers of the person firm’s efficiency.

Every technique requires cautious consideration of the investor’s danger tolerance, monetary objectives, and understanding of the cryptocurrency markets. Keep in mind, no technique ensures success, so it’s vital to speculate solely what you may afford to lose.

Is It Sensible to Spend money on BTC Proper Now?

Investing in Bitcoin is a choice that comes with excessive volatility and danger. For these prepared to navigate these waters, it’s essential to have a stable understanding of what asset class you’re investing in and a strategic strategy to your crypto investments. Whereas Bitcoin is usually thought-about the prime entry level into the cryptocurrency market because of its simplicity and widespread accessibility, it ought to be a proportionate a part of your total portfolio.

A very good (and straightforward) approach to decide whether or not Bitcoin is value shopping for in the intervening time is to have a look at market evaluation charts just like the TradingView widget beneath. If it exhibits “Purchase,” which means the value of Bitcoin is more likely to rise quickly, whereas the “Promote” sign tells us there’s a potential for a downward pattern to look shortly.

Please word that the state of affairs can change at any time. It’s vital to do not forget that making an attempt to foretell and outsmart the market will at all times be a bet, irrespective of if it’s the crypto or inventory market we’re speaking about. The previous, nevertheless, is much more risky. That’s why, relating to cryptocurrency funding, it’s usually suggested to maintain your FOMO in verify and check out investing little by little over an extended time frame.

Conclusion

When considering investing in any asset, it’s at all times a good suggestion to think about the way it will match into your present portfolio. And for those who don’t have one but, take into consideration what different belongings — fiat currencies, valuable metals, digital currencies, and so forth — you’ll have to purchase as much as mitigate the chance and obtain your revenue objectives.

A simple approach to make a foolproof portfolio is to spend money on a high-risk, high-reward asset alongside gold or different valuable metals. In the end, whether or not you can purchase 100 {dollars} value of Bitcoins proper now relies on what you concentrate on this coin and crypto typically and its future potential.

Please word that the contents of this text shouldn’t be seen as funding recommendation. Good luck in your crypto journey!

FAQ

Can I generate profits investing $100 in Bitcoin?

Considering of investing $100 in Bitcoin? Sure, it’s doable to generate profits with that quantity. Whereas $100 received’t flip into an enormous sum in a single day, it might nonetheless yield respectable returns if Bitcoin does nicely. Beginning small in crypto is a great transfer, contemplating its dangerous nature. Your potential positive aspects rely upon what you’re aiming for. In search of large earnings? $100 may fall brief. However for those who’re aiming for some earnings or simply wish to expertise Bitcoin funding, $100 is an effective begin.

How a lot was $100 in Bitcoin 5 years in the past?

In 2019, with a median Bitcoin worth of round $7,200, an preliminary funding of $100 would have allowed you to buy roughly 0.01389 BTC. This may’ve given you round $972 for those who had bought that BTC in March 2024, when Bitcoin was $70K.

When ought to I money out Bitcoin?

Crypto’s volatility means it’s not nice for holding regular worth. Seeing your funding fluctuate wildly may be demanding. However don’t let short-term adjustments push you into promoting. Bitcoin, for example, may need a brighter future. Many say 2024 could possibly be pivotal for its worth. When to promote actually comes all the way down to your monetary goals and the market’s situation. Whether or not you’re aiming to money in earnings, scale back losses, or use your crypto, it’s vital. Simply take note the influence of taxes and the significance of excellent timing.

What is an effective Bitcoin pockets?

Learn additionally: Greatest BTC wallets.

A very good Bitcoin pockets is one which balances safety, accessibility, and user-friendliness. As an example, the Exodus pockets is very rated for its modern interface and help of an unlimited variety of cryptocurrencies, making it preferrred for rookies. One other nice choice is Ledger, a {hardware} pockets that shops your Bitcoin offline and, due to this fact, is much less inclined to hacking.

Nonetheless, the last word alternative relies on whether or not you like comfort over safety or vice versa, as on-line wallets (like Exodus) enable quick access for Bitcoin purchases, whereas {hardware} wallets (like Ledger) present superior safety for these doubtlessly dangerous belongings.

What’s one of the simplest ways to purchase BTC?

The easiest way to purchase BTC typically relies on particular person wants and circumstances. Nonetheless, usually, probably the most safe and handy approach to buy Bitcoin is thru a well-established cryptocurrency change like Coinbase or Binance. These platforms help you purchase, promote, and commerce Bitcoin immediately utilizing your native foreign money or different cryptocurrencies.

Cost strategies can range, however most platforms usually settle for debit playing cards, financial institution transfers, and even PayPal in some areas. Keep in mind, every transaction could also be topic to a transaction price, which might differ between exchanges.

What’s one of the simplest ways to purchase BTC?

The easiest way to purchase BTC typically relies on particular person wants and circumstances.

To purchase BTC, step one is organising a cryptocurrency change account on a good platform. After finishing the required verification, you may fund your account with conventional foreign money. To buy Bitcoin, you may place both a market order for instant buy on the present worth or a restrict order at a predetermined worth.

It’s important to strategy Bitcoin as a speculative funding because of its risky nature. Make investments cautiously, solely utilizing funds you may afford to danger.

For enhanced safety, particularly with bigger investments, it’s advisable to switch your Bitcoin from the change to a private cryptocurrency pockets, both a software program pockets in your gadget or a safer {hardware} pockets.

The best way to begin investing in Bitcoin?

Beginning your Bitcoin funding journey includes just a few steps. First, decide how a lot you’re prepared to speculate, holding in thoughts that Bitcoin and different cryptocurrencies are speculative and dangerous belongings. Second, arrange a safe digital pockets the place you may retailer your Bitcoin. Subsequent, create an account with a good cryptocurrency change the place you’ll make your Bitcoin purchases.

Then, you can begin shopping for Bitcoin, however bear in mind of the present market traits and the way a lot Bitcoin is value on the time of buy. Be conscious when promoting Bitcoin, too, as timing is essential on this risky market. It’s additionally worthwhile to think about choices like Bitcoin Alternate Traded Funds (ETFs), which let you spend money on Bitcoin with out truly proudly owning it.

The place can I spend money on Bitcoin?

You’ll be able to spend money on Bitcoin on varied platforms. Cryptocurrency exchanges are the most typical platforms for purchasing and promoting Bitcoin. Some well-liked ones embody Coinbase, Binance, and Kraken. These platforms help you commerce Bitcoin immediately and often help a big selection of different cryptocurrencies. Moreover, sure conventional brokers and inventory buying and selling apps are starting to supply Bitcoin and different crypto belongings.

Lastly, Bitcoin ETFs supply another approach to spend money on the worth of Bitcoin with out having to handle and safe the digital foreign money your self. Make sure you select a platform that aligns together with your funding technique and supplies satisfactory safety measures.

Can I lose cash on Bitcoin?

Sure, completely. It doesn’t matter what Bitcoin investing methods you employ or how safe your pockets and change are, there’s at all times a danger of shedding your funds. Nonetheless, you may decrease these dangers.

We give just a few normal recommendations on how to not lose your cash whereas exchanging crypto in our article on refunds. Spoiler alert: It’s arduous to refund crypto and Bitcoin transactions, so be certain to double-check all information you enter when making a purchase order!

Can investing in Bitcoin make you rich?

Effectively, it relies on once you’re going to promote Bitcoin and the way a lot it can rise sooner or later. That mentioned, Bitcoin is not at that stage the place you may make thousands and thousands and even 1000’s of {dollars} by investing as little as $10 in it — if that’s what you’re after, you’ll be higher off betting on the success of random shitcoins.

Nonetheless, there’s one other approach to turn out to be rich by investing as little as $100 in Bitcoin or every other well-liked cryptocurrencies: doing it frequently, similar to the way you’d prime up your financial savings account.

How a lot Bitcoin ought to I purchase?

If you wish to buy Bitcoin proper now, you need to solely spend as a lot as you may afford to lose. This is without doubt one of the important guidelines for purchasing cryptocurrency, irrespective of if you wish to make investments $20, $100, or $1,000 in Bitcoin or any altcoin.

The quantity you purchase may also rely in your funding objectives and the way a lot revenue you’re hoping to get. You probably received’t see sky-high returns for those who purchase $100 value of Bitcoin together with your fiat foreign money. Nonetheless, keep in mind to maintain a cool head and spend responsibly.

How a lot ought to I spend money on crypto monthly?

Investing little by little each month is without doubt one of the most typical items of recommendation you may hear. The precise quantity will rely in your earnings, life state of affairs, urge for food for danger, and so forth.

Some individuals make investments as little as $20 monthly in Bitcoin or different cryptocurrency — the value of some cups of espresso. That is one thing you need to resolve for your self.

Disclaimer: Please word that the contents of this text will not be monetary or investing recommendation. The data offered on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native laws earlier than committing to an funding.

[ad_2]

Source link