[ad_1]

In a major growth that would doubtlessly influence the Bitcoin value, Arkham Intelligence knowledge reveals that Grayscale, the supervisor and proprietor of the Grayscale Bitcoin Belief (GBTC), has been sending a major quantity of Bitcoin to Coinbase for the reason that launch of Bitcoin spot exchange-traded funds (ETFs) on January 12.

Grayscale Bitcoin Belief Initiates Substantial BTC Outflow

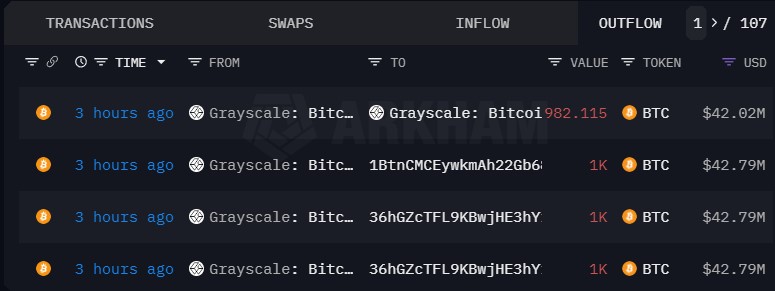

In accordance with the knowledge, 4 days in the past, Grayscale initiated the primary batch of BTC outflows from their holdings to the US-based trade in 4 separate batches, totaling 4,000 BTC, which amounted to roughly $183 million. Nonetheless, the asset supervisor resumed outflows from the Belief to the trade on Tuesday.

In a current replace, roughly three hours in the past, the asset supervisor despatched an extra 11,700 BTC to Coinbase, amounting to $491.4 million. This extra promoting strain may push the Bitcoin value to check decrease assist ranges.

Moreover, Bloomberg studies that traders have withdrawn over half a billion {dollars} from the Grayscale Bitcoin Belief throughout the preliminary days of buying and selling as an ETF.

In accordance with Bloomberg’s knowledge, outflows from the Grayscale Bitcoin Belief reached roughly $579 million, whereas the opposite 9 spot Bitcoin ETFs witnessed inflows totaling practically $819 million.

Traders Shift Capital To ‘Decrease-Value’ Spot Bitcoin ETFs

James Seyffart, an ETF analyst at Bloomberg Intelligence, famous that traders could also be profit-taking following the ETF conversion. The circulation knowledge supplies priceless insights into the ETF’s efficiency following SEC approval.

Though over $2.3 billion of GBTC shares have been traded on its first day, the outflows point out {that a} portion of that quantity was as a result of promoting. Seyffart anticipates {that a} vital quantity of capital will enter different Bitcoin exposures.

The outflows from Grayscale’s ETF have been considerably anticipated. Bloomberg Intelligence had beforehand projected that the fund would expertise outflows of over $1 billion within the coming weeks.

A few of this outflow could be attributed to traders shifting in direction of cheaper spot Bitcoin ETFs. With an expense ratio of 1.5%, GBTC is the most costly US ETF instantly investing in Bitcoin. In distinction, the VanEck Bitcoin Belief, the second-most costly fund, fees 0.25%.

Then again, different spot Bitcoin ETFs have witnessed internet inflows. BlackRock’s IBIT attracted practically $500 million within the first two days of buying and selling, whereas Constancy’s FBTC acquired roughly $421 million.

In accordance with Bloomberg, these inflows counsel sturdy demand for Bitcoin publicity in bodily backed ETFs, even past potential seed funding from the fund issuers.

Bitcoin Worth Finds Help At $42,000

Presently, the Bitcoin value stays unaffected by the information of Grayscale’s transfers to Coinbase. The main cryptocurrency is buying and selling at $43,100, exhibiting a slight improve of 0.8% over the previous 24 hours.

Nonetheless, for the reason that graduation of ETF buying and selling, you will need to word that the Bitcoin value has skilled a major retracement, declining by 8%. This decline could be attributed to profit-taking and promoting strain, with Grayscale’s involvement being noteworthy.

Within the occasion of an additional drop within the Bitcoin value, a major assist degree has been established at $42,000. If this degree is breached, the following key degree for Bitcoin bulls to observe is $41,350, adopted by a possible dip beneath $40,000.

The market is eagerly observing whether or not Grayscale and its BTC selloff will proceed and the way this may influence the Bitcoin value main as much as the scheduled halving occasion in April, which many contemplate to be the primary catalyst for the yr.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info supplied on this web site fully at your personal threat.

[ad_2]

Source link