[ad_1]

Knowledge exhibits the whole open curiosity within the crypto sector has not too long ago been at an all-time excessive, indicating that volatility could also be coming for the cash.

Crypto Open Curiosity Has Been At Excessive Ranges Lately

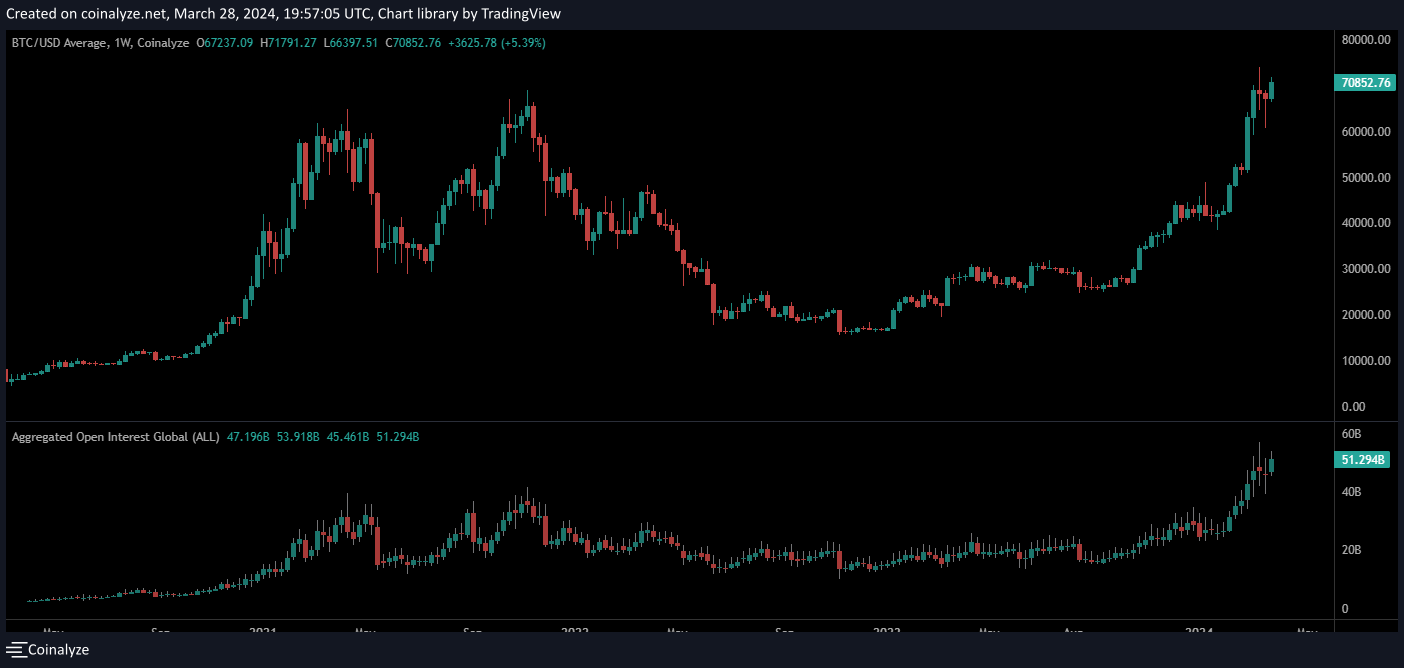

As CryptoQuant Netherlands group supervisor Maartunn identified in a submit on X, the whole crypto open curiosity has not too long ago been sitting round a whopping $51.3 billion.

The “open curiosity” right here refers back to the whole quantity of by-product positions associated to all digital property presently open on the varied exchanges within the sector.

When the worth of this metric rises, it implies that the buyers are opening up recent positions in the marketplace proper now. Usually, the whole leverage within the sector goes up when such a pattern takes kind, so the property may develop into extra prone to present some volatility.

Alternatively, a downtrend within the indicator implies that the buyers are closing their positions of their very own volition or getting forcibly liquidated by their platform.

A pointy plunge within the metric may accompany some violent value motion, however as soon as the indicator’s worth has settled down, the markets may develop into extra steady resulting from a washout of leverage.

Now, here’s a chart that exhibits the pattern within the crypto open curiosity over the previous few years:

The worth of the metric seems to have been going up in latest days | Supply: @JA_Maartun on X

As displayed within the above graph, the whole open curiosity within the crypto sector has been using an uptrend not too long ago. This rise within the metric has come as the costs of Bitcoin and different property have gone by means of their rallies.

This isn’t uncommon, because the market attracts a lot consideration throughout such value motion. With a considerable amount of consideration naturally comes hypothesis, so customers flood exchanges with positions in these durations.

From the chart, it’s seen that open curiosity within the crypto market additionally rose throughout the 2021 bull run. The newest values of the indicator, nonetheless, have already surpassed the height witnessed again then.

The metric has not too long ago been round $51.3 billion, an all-time excessive. As talked about earlier than, excessive metric values can result in volatility for the varied property within the sector.

As such, the present excessive ranges of open curiosity may imply that the market could also be liable to seeing some sharp value motion within the close to future. This volatility may take the market in both route, at the very least on paper.

As is clear from the graph, although, the indicator has traditionally solely seen a big cooldown with crashes within the Bitcoin value, so the present overheated open curiosity could also be a foul signal for the crypto market.

Bitcoin Worth

On the time of writing, Bitcoin is floating across the $70,100 mark, up greater than 9% over the previous week.

Appears like the worth of the asset has gone stale not too long ago | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com

[ad_2]

Source link