[ad_1]

Cardano (ADA) showcased exceptional progress through the fourth quarter (This autumn) of 2023, surpassing its rivals and demonstrating spectacular progress in key metrics, based on a Messari report.

Common Every day Transactions Soar In This autumn

The report highlights that ADA’s income in USD elevated by 66.7% quarter-over-quarter (QoQ), pushed not solely by ADA’s worth motion but additionally by a ten.6% QoQ improve in income denominated in ADA.

Moreover, Cardano’s Treasury stability expanded by 2.6% QoQ, reaching 1.43 billion ADA, in keeping with progress traits noticed in earlier quarters. At the moment, 20% of transaction charges contribute to the treasury, which might be adjusted by means of governance.

One other key metric, transactions, reveals that Cardano skilled 10.9% QoQ progress in common every day transactions, outpacing the 1.6% QoQ progress in every day lively addresses. The ratio of transactions to lively addresses has steadily elevated over the previous 12 months, indicating elevated energy customers.

In This autumn, the ratio of transactions to lively addresses elevated 9.2% sequentially and 45.0% year-over-year (YoY), reflecting larger common exercise per consumer as a result of introduction and improvement of assorted protocols all through 2023.

When it comes to stake, lively stake declined by 0.5% QoQ for the second consecutive quarter, amounting to 22.8 billion ADA. Engaged stake additionally remained comparatively flat within the second half of 2023. Nonetheless, lively and engaged stake witnessed a YoY lower of 10.2% and 9.6%, respectively.

Cardano TVL Reaches New Milestone

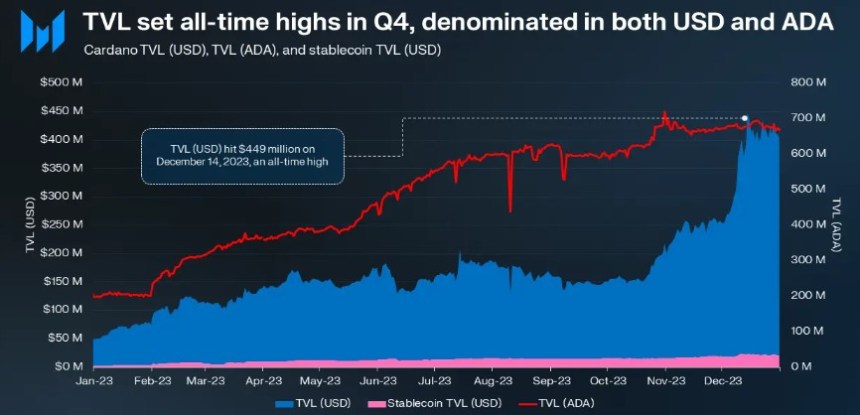

With the thawing of the crypto winter, the Cardano ecosystem skilled a major surge in Complete Worth Locked (TVL) in USD, skyrocketing 166% QoQ and 693% YoY.

Indigo emerged as the biggest protocol by TVL, surpassing Minswap. TVL of stablecoins on Cardano elevated by 37% QoQ and 673% YoY, with the addition of Mehen’s USDM fiat-backed stablecoin scheduled to launch in March.

Notably, TVL in USD reached an all-time excessive of $449 million on December 14th, representing the This autumn progress of 166%. This surge contributed to Cardano’s rise in TVL rankings from fifteenth to eleventh throughout This autumn, following its preliminary place of thirty fourth initially of the 12 months. TVL denominated in ADA additionally achieved an all-time excessive, peaking at simply over 700 million ADA.

In keeping with the report, Cardano’s TVL progress was primarily pushed by the introduction of recent stablecoins, specifically iUSD and DJED, early in 2023. Stablecoins remained an important indicator of decentralized finance (DeFi) well being, as the whole worth locked in secure belongings rose by 36.8% to $21.5 million. Cardano’s stablecoin market cap additionally improved from 54th to thirty second amongst different networks.

Nonetheless, non-fungible token (NFT) exercise declined throughout This autumn. Transactions and buying and selling quantity within the NFT house decreased by 8.0% and 33.8% QoQ, respectively. Yearly, NFT transactions and buying and selling quantity considerably declined by 58.3% and 68.3%, respectively.

The one metric to indicate progress in 2023 was the variety of distinctive sellers, which elevated by 213.2% YoY, averaging 270 distinctive sellers every day.

Lastly, ADA’s worth surged 127.2% QoQ, outperforming the general crypto market’s 53.8% improve. This This autumn surge contributed to ADA’s YoY change of 145.2%.

As of now, ADA continues to indicate vital positive factors with its present buying and selling worth of $0.5724. This displays a major improve of 5.5% over the previous 24 hours and eight% over the previous 30 days. These figures additional solidify the bullish momentum of the token because the market enters the center of the primary quarter of 2024.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use data supplied on this web site fully at your individual danger.

[ad_2]

Source link