[ad_1]

In a exceptional show of bullish momentum, the Bitcoin (BTC) value has surged, practically touching its all-time excessive of $69,044 set in November 2021. The cryptocurrency’s worth climbed to a powerful $68,848 earlier than dealing with a 5% correction, subsequently dropping to $64,200.

Nevertheless, the market swiftly recovered, with BTC buying and selling above $67,000 as soon as once more. This surge will be attributed to a mixture of things fueling the upward trajectory. Right here, we delve into the 5 key causes behind Bitcoin’s latest value actions.

#1 Provide Shock Due To Bitcoin ETF Demand

The spot Bitcoin ETF market has witnessed one more day with vital inflows, notably spotlighting Constancy and BlackRock, which funneled greater than $400 million every into BTC. Constancy recorded a historic influx of $404.6 million, whereas BlackRock adopted intently with $420 million.

Document day for Constancy at the moment: US$404.6 million of influx

Constancy has greater than offset the GBTC outflow by itself https://t.co/cr320pbObf pic.twitter.com/ellb4qUoNK

— Farside Buyers (@FarsideUK) March 5, 2024

Eric Balchunas, a senior ETF analyst at Bloomberg, remarked on the phenomenon: “The ten Bitcoin ETFs a digital lock to clock their second greatest quantity day at the moment. So seems like the large bump up in buying and selling exercise final week was extra new regular than anomaly. At this time was the second greatest quantity day for the Ten at about $5.5b. $IBIT alone did $2.4b of it and has crossed $11b in aum.”

This inflow is indicative of a provide shock, because the demand from ETFs absorbs a considerable portion of obtainable Bitcoin, decreasing provide and thereby pushing costs upward.

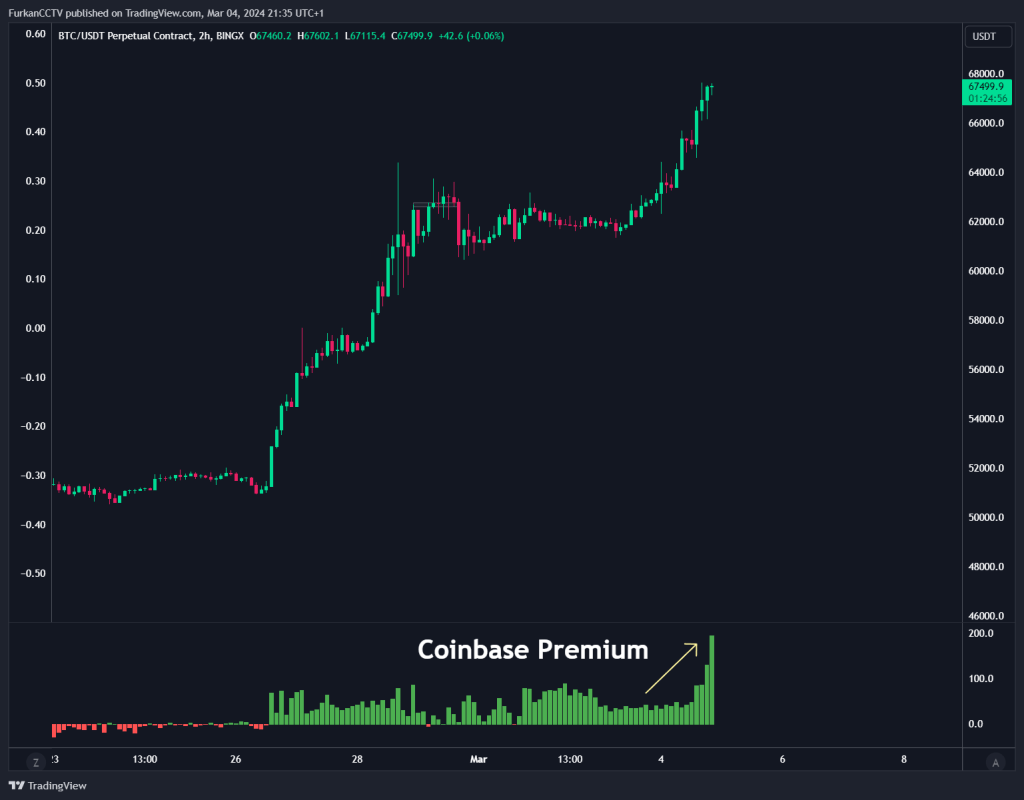

#2 Coinbase Premium Alerts Institutional Shopping for

The surge in BTC’s value can be mirrored by the numerous enhance within the Coinbase Premium, a transparent indicator of institutional curiosity. Furkan Yildirim, a famous crypto analyst, acknowledged, “The Coinbase Premium is in full blast, signaling a possible all-time excessive for Bitcoin.” This sentiment was echoed by @tedtalksmacro, who noticed, “Giant BTC spot premium over at Coinbase. The large boys are shopping for. […] For context, that is the biggest premium noticed on this leg increased. Institutional FOMO.”

The Coinbase Premium, a metric indicating the worth distinction between Coinbase’s BTC value and different exchanges, serves as a bullish sign, highlighting the aggressive shopping for by establishments and high-net-worth people, particularly throughout common buying and selling hours.

#3 BlackRock’s Strategic Transfer Into Bitcoin

BlackRock’s latest submitting to combine BTC publicity into its Strategic Revenue Alternatives Fund (BSIIX) is one more watershed second. With the fund’s substantial $36.5 billion belongings beneath administration, this inclusion signifies a serious nod to Bitcoin’s rising acceptance amongst conventional funding automobiles.

Whereas BSIIX is just not the most important fund, it may very well be the beginning sign for Bitcoin ETFs to be included in bigger and, above all, extra funding funds by BlackRock and others. This may be extraordinarily bullish. “Wall Road corporations proceed to file for Bitcoin ETF publicity of their in-house funding funds. You’re going to see lots of this within the coming months,” commented MacroScope, a outstanding crypto analyst on X (previously Twitter).

#4 MicroStrategy’s Continued Bitcoin Accumulation

MicroStrategy introduced a brand new issuance of $600 million in Convertible Senior Notes, earmarked for BTC purchases and normal company functions. This transfer signifies not simply an funding technique however a profound perception in Bitcoin’s worth proposition. This technique not solely underscores Saylor’s bullish outlook on BTC but in addition introduces a big shopping for strain out there.

MicroStrategy Proclaims Proposed Personal Providing of $600 Million of Convertible Senior Notes $MSTR https://t.co/PEN5dxesIb

— Michael Saylor⚡️ (@saylor) March 4, 2024

#5 The ‘Kimchi Premium’ Phenomenon

The ‘Kimchi Premium‘—the worth hole between South Korean exchanges and overseas ones—has re-emerged as a notable issue. On Upbit, South Korea’s largest trade, BTC and ETH have been buying and selling at premiums of roughly 6% and seven%, respectively.

This exhibits that it’s not solely the US market which is driving the BTC value. The Kimchi premium is a testomony to the excessive demand and speculative curiosity throughout the South Korean market.

At press time, BTC traded at $67,008.

Featured picture created with DALL·E, chart from TradingView.com

[ad_2]

Source link