[ad_1]

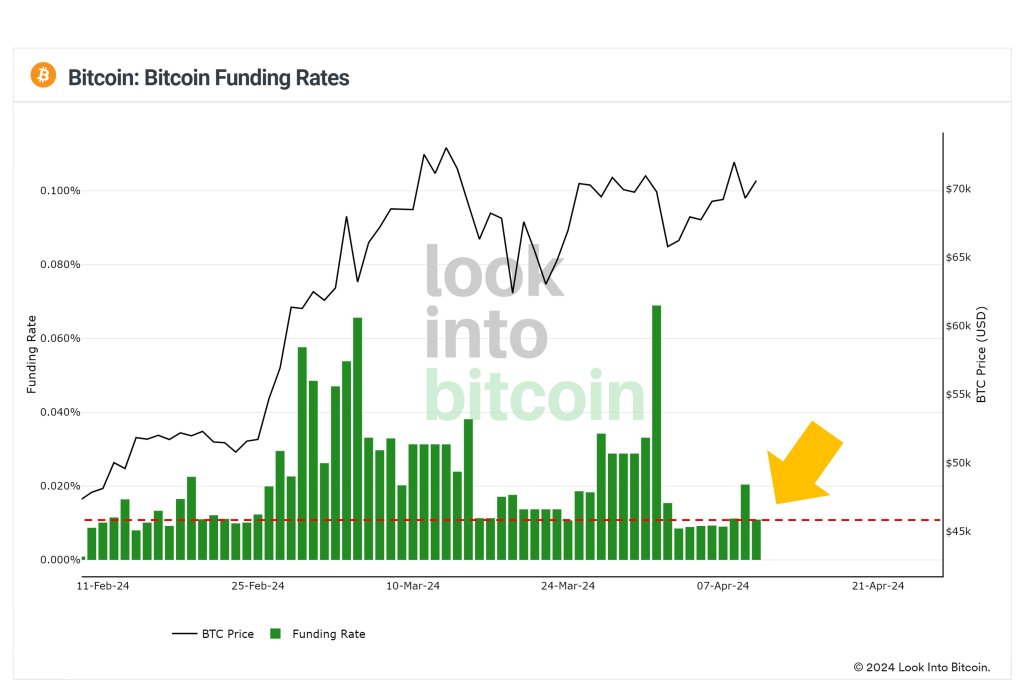

Bitcoin, one analyst notes on X, is wanting wholesome for the primary time because the coin soared to over $70,000, printing all-time highs again in March 2024. The evaluation is because of funding charges dropping to inside bizarre ranges, an indicator that volatility can be falling and moments of concern of lacking out (FOMO) are fading.

Funding Charges At “Regular Ranges” As FOMO Dissipates

In crypto perpetual buying and selling, the funding price is the payment exchanged between market individuals. These charges are market-determined and are adjusted each eight hours or so.

Relying on market situations, they are often optimistic or adverse. Nonetheless, they play a vital function in figuring out momentum. Of be aware, bulls pay a payment to bears When perpetual costs are larger than the spot value. This, in flip, discourages shopping for within the perpetual market and incentivizes shopping for into the spot, bringing costs nearer.

Each time costs rally, as has been the case because the begin of the 12 months when Bitcoin has typically been within the inexperienced, those that enter lengthy should pay sellers to maintain costs from deviating, as talked about above.

Nonetheless, at spot charges, the speed leveraged patrons are paying is barely decrease as FOMO drops. As soon as costs quickly broaden, ideally above March 2024 highs, this funding price will possible enhance to February and March 2024 ranges.

Thus far, Bitcoin is altering fingers above $70,800 at spot charges and inside a bullish formation. Of be aware is that patrons are in command of reversing losses posted on April 8.

Even so, for the uptrend to stay, costs should escape above $72,500 and the April 8 excessive on rising quantity. BTC will possible float to over $73,800 and enter value discovery in that case.

Bitcoin Rises After CPI Information In America, Establishments Pouring In?

With FOMO dissipating and “normalcy resuming,” the analyst mentioned the coin is now higher positioned to soar larger, backed by natural momentum generated from market individuals. After dipping barely on April 9, the coin rose following optimistic information in regards to the Client Worth Index (CPI) in the US.

Whereas the “sizzling” CPI pushed different belongings decrease, Bitcoin costs bounced to identify ranges. Consultants say the coin would possibly profit as risk-averse merchants shift to safe-haven cash to protect their worth from raging inflation.

Past this, analysts anticipate demand for spot Bitcoin exchange-traded funds (ETFs) to rise within the months forward. As establishments pour in, shopping for shares of spot BTC ETFs issued by gamers like Constancy, the demand for the underlying coin would possibly soar to recent ranges, lifting costs. Furthermore, some analysts are bullish, saying costs will profit as soon as GBTC stops offloading cash.

Characteristic picture from DALLE, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site fully at your personal danger.

[ad_2]

Source link