[ad_1]

Because the countdown to the much-anticipated 2024 bitcoin halving occasion nears its climax, the cryptocurrency world finds itself amidst a whirlwind of pleasure and hypothesis.

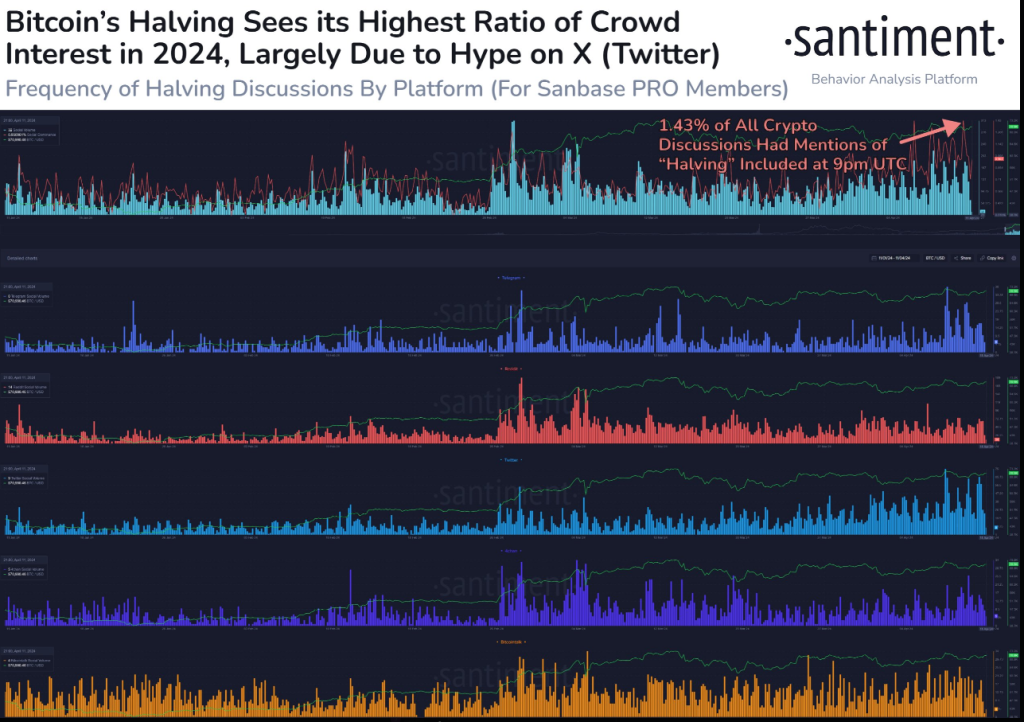

Social media platforms have turn into abuzz with discussions surrounding the upcoming halving, based on information from Santiment. This enhance in social media chatter signifies a possible for important worth actions within the risky crypto market, sparking each FOMO (Concern of Lacking Out) and FUD (Concern, Uncertainty, Doubt) amongst traders.

Social Media Surge Fuels Hypothesis On Bitcoin’s Destiny

The surge in social media chatter across the halving occasion has not gone unnoticed by analysts, who recommend that such peaks in exercise usually coincide with notable shifts in market sentiment and worth motion.

Whereas some consider that the heightened discussions may sign a possible worth rally, others stay cautious, declaring the latest flat market situations which will dampen the occasion’s affect.

⌛️🗣️ As #Bitcoin has now drawn to its last week earlier than the #halving, social dominance towards the subject has peaked at its highest stage of the yr at 9pm UTC. The spikes on this matter must be acquired as excessive confidence worth reversals for #crypto markets. Markets have been… pic.twitter.com/U2dOujjhLj

— Santiment (@santimentfeed) April 12, 2024

Distinctive Dynamics Surrounding Bitcoin 2024 Halving

This forthcoming halving occasion carries a singular set of circumstances, setting it aside from its predecessors. Bitcoin’s present buying and selling place above its earlier cycle’s excessive provides a component of unpredictability to the equation, making it difficult to forecast the period and depth of the upcoming bull run.

Consultants weigh in on the confluence of diminished provide and rising ETF demand as potential catalysts driving Bitcoin into uncharted territory.

Supply: Santiment

Antoni Trenchev, co-founder of Nexo, highlights the significance of understanding the demand dynamics available in the market, significantly on the subject of whale demand for BTC, involving veteran Bitcoiners, newcomers, and ETF holders.

Associated Studying: XRP To Blast Off? Analyst Predicts ‘Reasonable’ 5x Surge To $3

Trenchev means that this heightened demand may enlarge the affect of the upcoming provide shock, paving the best way for a shorter however extra intense bull market.

Whole crypto market cap is at the moment at $2.38 trillion. Chart: TradingView

Skilled Views: Optimism Vs. Warning

Whereas some specialists stay cautiously optimistic in regards to the potential outcomes of the halving occasion, others warn in opposition to overestimating its affect.

Steven Lubka, Head of Personal Purchasers at Swan Bitcoin, emphasizes the significance of sustaining a level-headed strategy amidst the frenzy surrounding the halving. Lubka means that whereas the occasion could spark short-term worth fluctuations, its long-term results are more likely to be extra subdued.

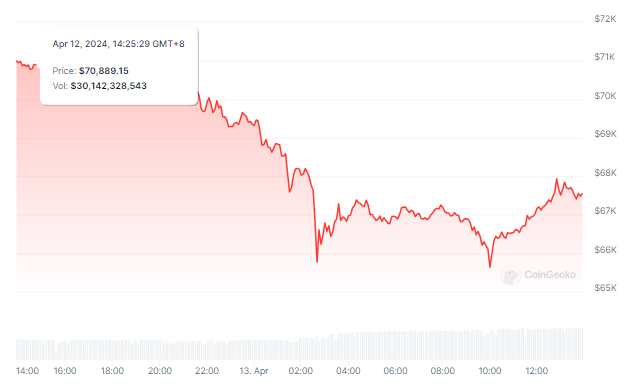

Bitcoin worth motion within the final day. Supply: Coingecko

Bitcoin worth motion within the final day. Supply: Coingecko

Because the countdown to the bitcoin halving occasion reaches its crescendo, the crypto neighborhood finds itself grappling with a combination of hope and warning. Whereas some anticipate important adjustments available in the market panorama, others brace themselves for a extra tempered response.

Featured picture from ZebPay, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site completely at your personal threat.

[ad_2]

Source link