[ad_1]

The analytics agency Santiment has revealed the listing of altcoins which might be displaying the best bullish and bearish divergences at present.

RSI Reveals These Altcoins To Comprise The Most Excessive Values Proper Now

In a brand new publish on X, Santiment has mentioned some altcoins which might be displaying overvalued or undervalued situations primarily based on the Relative Power Index (RSI) at present.

The RSI refers to a momentum metric in technical evaluation that tracks the velocity and magnitude of current modifications occurring within the worth of any given asset. This measurement could be remodeled any interval, however within the context of the present subject, the 1-day RSI is of relevance.

Typically, a excessive worth of this indicator could be a signal that the asset is overheated proper now and could also be prone to forming a prime. Extra particularly, the 70 mark is chosen because the cutoff for when the likelihood of a bearish reversal turns into vital.

Then again, the RSI being 30 or decrease can suggest the value is underneath its truthful worth in the meanwhile, and as such, a possible reversal to the upside might be brewing for the asset.

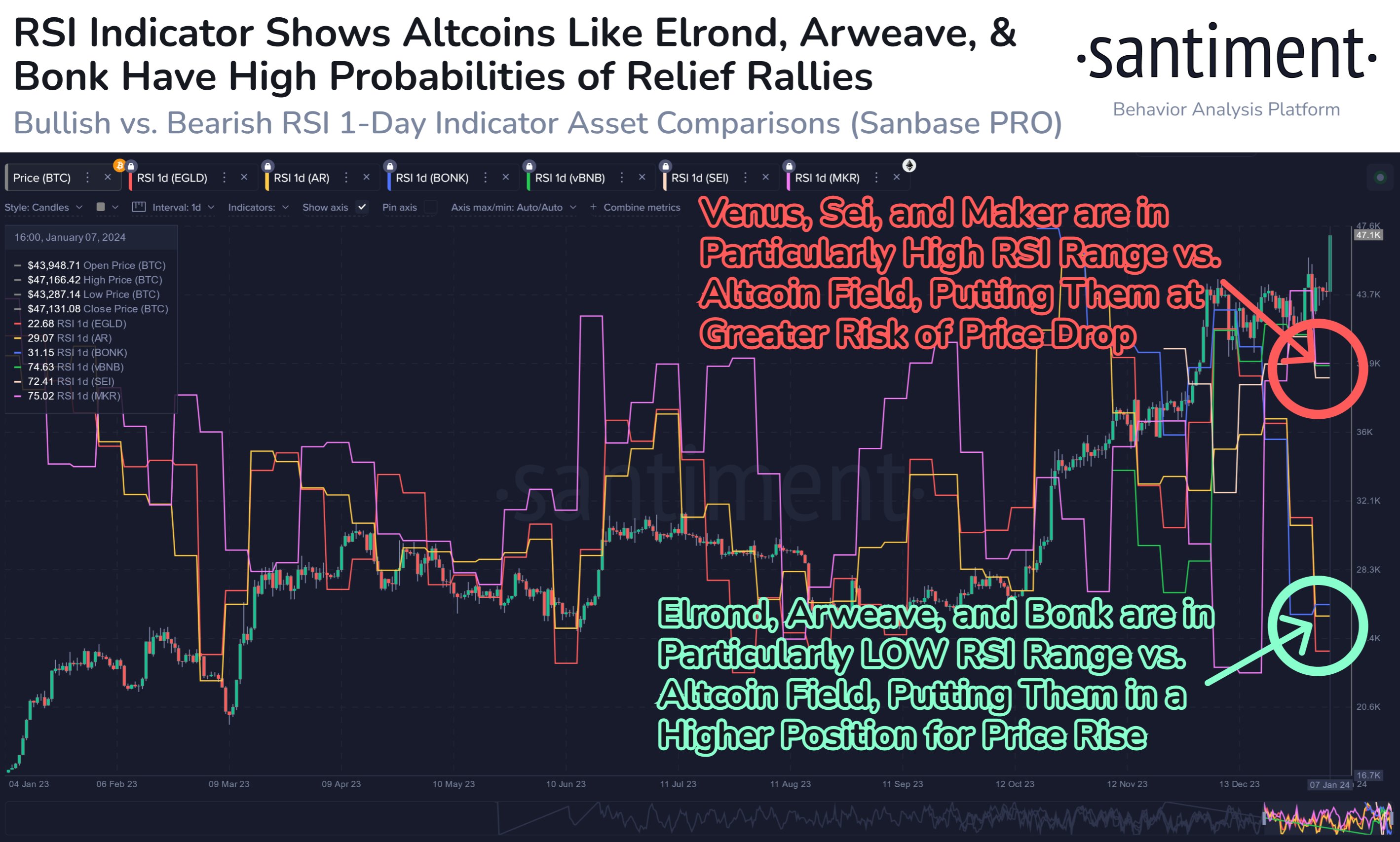

Now, right here is the chart shared by the analytics agency that reveals the pattern within the 1-day RSI for a couple of completely different altcoins from the highest 150 market cap listing over the previous yr:

Appears like three of those cash have a low worth of the metric, whereas the opposite three are at excessive ranges | Supply: Santiment on X

As displayed within the above graph, the 1-day RSI has been at excessive ranges for Maker (MKR), Venus (vBNB), and Sei (SEI) not too long ago. To be extra particular, the metric has a worth of 74.6, 72.4, and 75 for vBNB, SEI, and MKR, respectively.

Clearly, these RSI ranges are within the zone usually related to an overheated market. Maker has not too long ago loved a pointy rally, observing beneficial properties of over 30% in the course of the previous couple of weeks. If this metric is something to go by, although, the asset’s robust run could also be approaching an finish.

On the opposite finish of the spectrum are the altcoins Elrond (ELGD), Arweave (AR), and Bonk (BONK), that are observing low ranges of 1-day RSI. ELGD and AR are contained in the underpriced zone with the metric sitting at 22.6 and 29, whereas the Solana-based memecoin BONK is floating simply over the world with a worth of 31.

In response to Santiment, all six of those cash have additionally separated from the remainder of the altcoins cohort, implying a bearish/bullish (relying on whether or not overvalued or undervalued) divergence might be forming for them.

As such, cash like BONK observing a bullish divergence could also be prone to see some worth rise, in order that they’ll meet up with the opposite alts. Equally, MKR and others might even see a correction to be extra according to the remainder of the market.

BONK Worth

Bonk has had a nasty time these previous couple of weeks, as its worth has been following an general downward trajectory. The coin could lastly be beginning to flip itself round, nonetheless, as its worth has shot up over 22% prior to now 24 hours.

The value of the coin appears to have jumped over the previous day | Supply: BONKUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Santiment.web

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site solely at your personal threat.

[ad_2]

Source link