[ad_1]

The value of Bitcoin has continued to soar this week, with the premier cryptocurrency consolidating its place above the $50,000 mark. Curiously, on-chain information exhibits {that a} specific class of buyers had much less to do concerning the current rally, sparking conversations about their participation within the present bull cycle.

Latest BTC Value Primarily Fueled By ‘Institutional Demand’

In a current put up on X, analyst Ali Martinez identified that there was an obvious decline within the involvement of retail buyers within the Bitcoin market. This shift comes regardless of the current surge within the flagship cryptocurrency’s value.

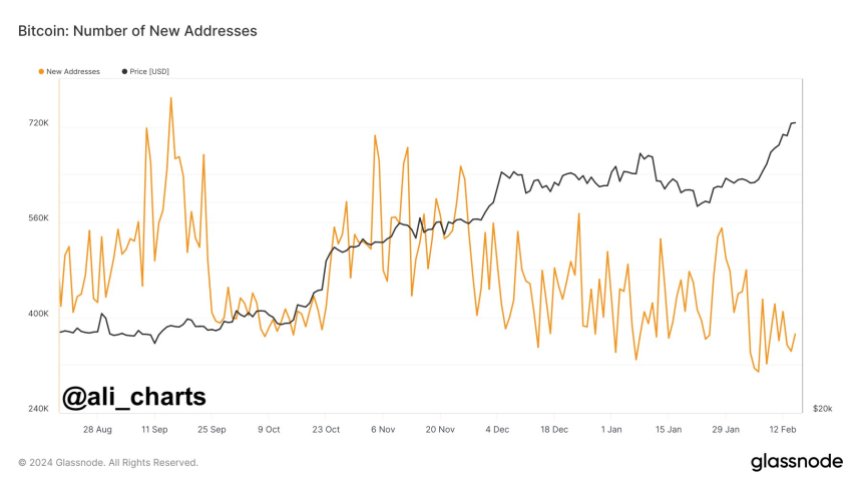

This revelation relies on the noticeable fall within the every day creation of latest Bitcoin addresses. In response to the crypto intelligence platform Glassnode, this metric tracks the variety of distinctive addresses that appeared for the primary time in a transaction of the native coin within the community.

Chart displaying the variety of new addresses on the Bitcoin community | Supply: Ali_charts/X

Sometimes, extra people are inclined to enter the market as the worth of Bitcoin will increase, usually leading to a spike in new addresses to retailer and transact the coin. Nonetheless, there’s presently a deviation between the BTC value and the creation of latest addresses.

In response to Martinez, this curious pattern suggests a scarcity of retail participation within the ongoing Bitcoin bull run. The crypto analyst, nevertheless, tied the flagship cryptocurrency’s current constructive efficiency to institutional gamers’ exercise.

This evaluation appears to carry some weight, contemplating it’s been somewhat over a month because the Securities and Change Fee authorised the buying and selling of spot BTC exchange-traded funds in america. These funding merchandise are issued and managed by among the world’s largest monetary firms, together with BlackRock, Grayscale, Constancy, and so forth.

Bitcoin Whales Present Highest Exercise Since 2022

One other on-chain revelation that considerably helps the argument of elevated institutional participation has emerged. In response to analytics platform Santiment, BTC whale exercise has been heating up currently, reaching its highest degree in over 20 months.

😮 Impartial from the spectacular quantity occurring with #Bitcoin #ETF’s, there was a definite flip within the degree of $BTC’s provide being held by totally different sized wallets:

🐳 1K-10K $BTC wallets: $12.95B added in 2024🐋 100-1K $BTC wallets: $7.89B dropped in 2024

(Cont) 👇 pic.twitter.com/BL7Mrj6kLq

— Santiment (@santimentfeed) February 16, 2024

Information from Santiment exhibits that wallets with 1,000 – 10,000 BTC are on an accumulation spree, including roughly 249,000 cash (value about $12.8 billion) in 2024 solely. Nonetheless, it’s value mentioning {that a} decrease tier of buyers (100 – 1,000 BTC) has offered greater than 151,000 Bitcoin because the yr began.

As of this writing, Bitcoin is valued at $51,950, reflecting a 0.6% decline prior to now day. Nonetheless, the premier cryptocurrency has retained most of its weekly revenue, having gained nearly 10% within the final seven days.

Bitcoin value hovering round $52,000 on the every day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site solely at your personal threat.

[ad_2]

Source link