[ad_1]

Spot Bitcoin ETFs have lastly been accepted by the US Securities and Trade Fee, and as anticipated, their approval led to a various market motion. The primary day of buying and selling for the 11 spot ETFs accepted turned out to be a memorable one, with nearly $4.6 billion price of ETF shares traded. ETF volumes have been additionally important through the second day of buying and selling, with regular exercise pushing the cumulative quantity to over $7.6 billion {dollars}.

In line with BitMEX Analysis, the online influx reported throughout the 11 spot Bitcoin ETFs was $532 million inside the first two days, with Blackrock popping out on high with $497.7 million price of BTC.

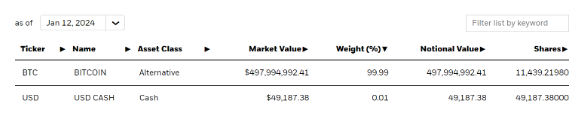

BlackRock’s Spot ETF Holdings

After two days of ETF buying and selling, statistics have revealed the standings of the 11 ETFs, these main the pack, and people falling behind. As anticipated, present information places Blackrock’s complete Bitcoin asset in its ETF forward of the pack. The primary day of buying and selling noticed Blackrock’s internet influx totaling $111.7 million, falling behind Bitwise and Constancy with $237.9 million and $227 million respectively.

Bitcoin Spot ETF Stream – Day 2 UPDATE

Stream quantity for Blackrock now in. Blackrock had $386m of influx. This offers Blackrock nearly $500m of influx within the first 2 days, possible placing it within the lead https://t.co/N0jYEQpgdg pic.twitter.com/xGzY8jvblO

— BitMEX Analysis (@BitMEXResearch) January 13, 2024

Notably, issues took a activate the second day of buying and selling. Blackrock had the very best internet influx of $386 million on day 2 to push its complete influx to $497.99 million within the first two days. In line with the web site for Blackrock’s spot bitcoin exchange-traded fund (ETF), the Ishares Bitcoin Belief (IBIT), the fund now holds 11,439.2 BTC.

Though the ETF launch has achieved properly below regular circumstances, it appears to have fallen quick of the massive numbers projected by many market analysts. In line with Blackrock CEO Larry Fink, the brand new ETFs are simply step one towards a brand new monetary world.

“ETFs are the 1st step within the technological revolution within the monetary markets. Step two goes to be the tokenization of each monetary asset,” he stated in an interview with CNBC.

BTC market cap at present at $840.141 billion. Chart: TradingView.com

Present State Of Bitcoin ETFs

The report from BitMEX Analysis additionally revealed the dynamics between the primary and second days of buying and selling. As said earlier, the primary day of buying and selling ended with nearly $4.6 billion in buying and selling quantity and a $625.8 internet influx. Nevertheless, buying and selling quantity fell to only over $3.1 billion on the second day, with BitMEX information revealing a decrease internet influx of $205 million.

Nearly all of the second-day outflow may be attributed to the Grayscale Bitcoin Belief. Regardless of main the market with about $1.9 billion in buying and selling quantity on the primary day, the fund didn’t register a internet influx, ending the day with $95.1 million in internet outflow. This outflow continued into day two, with the Grayscale Bitcoin Belief registering over $484 million internet outflow.

Featured picture from Shutterstock

[ad_2]

Source link