[ad_1]

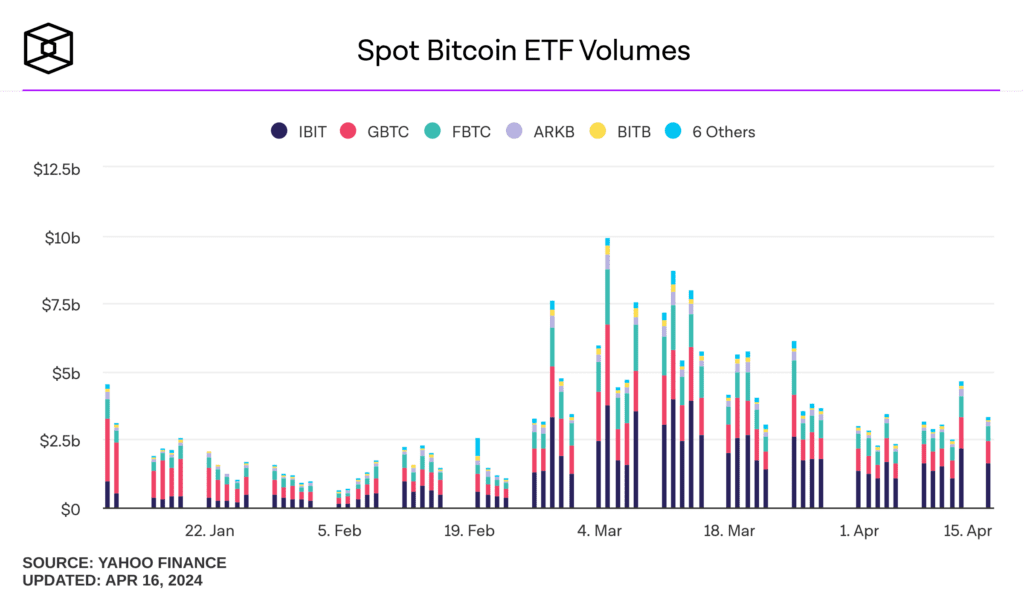

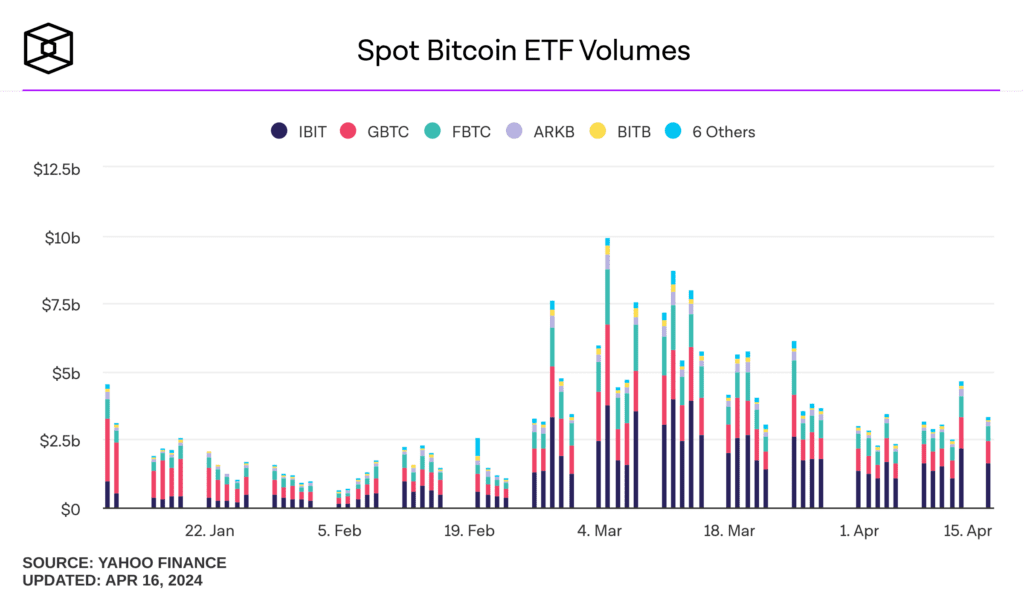

BlackRock’s Bitcoin exchange-traded fund (ETF), traded on Nasdaq with the ticker IBIT, continues to win market share. Earlier this month, IBIT’s share of Bitcoin ETF quantity crossed 50% for the primary time for the reason that 11 spot Bitcoin ETFs had been launched in mid-January.

In the meantime, the Grayscale Bitcoin Belief ETF (GBTC), which accounted for nearly 60% of all ETF buying and selling quantity in early days following the launch, is presently left with lower than 24%.

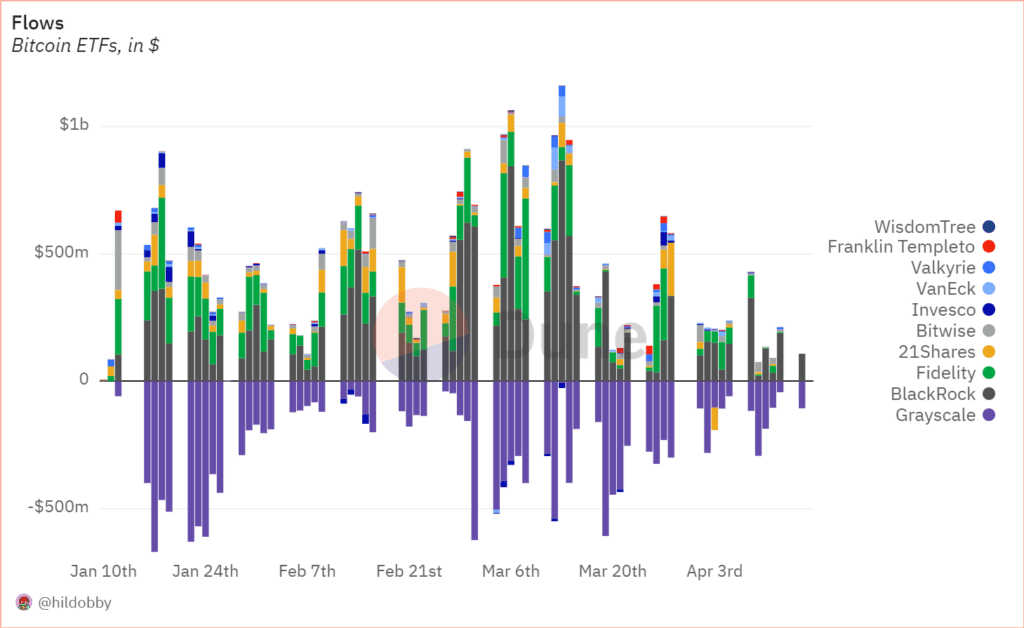

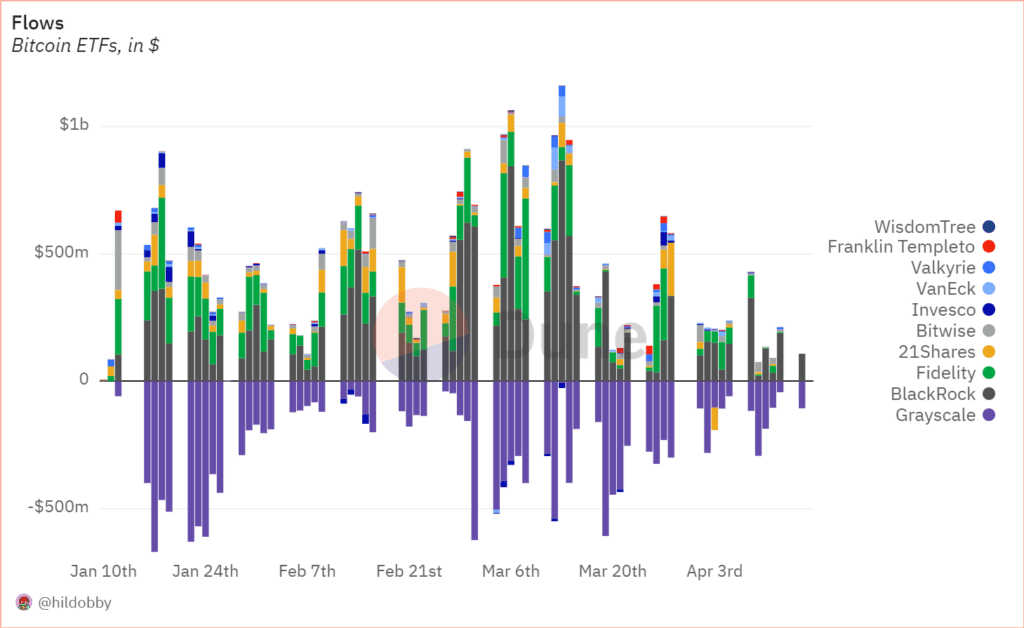

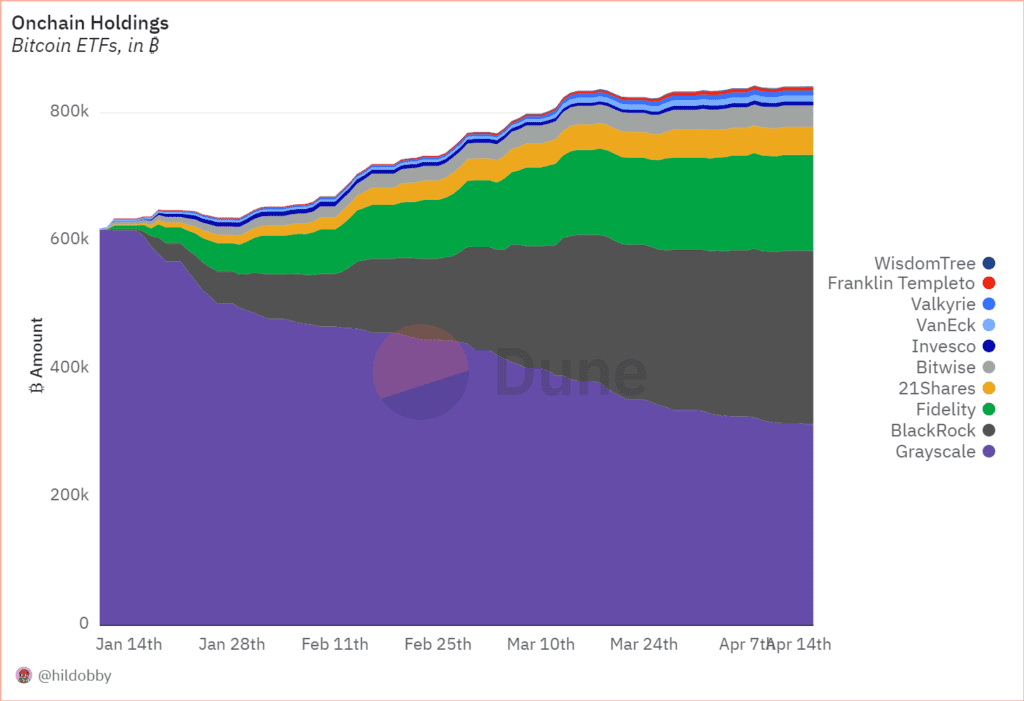

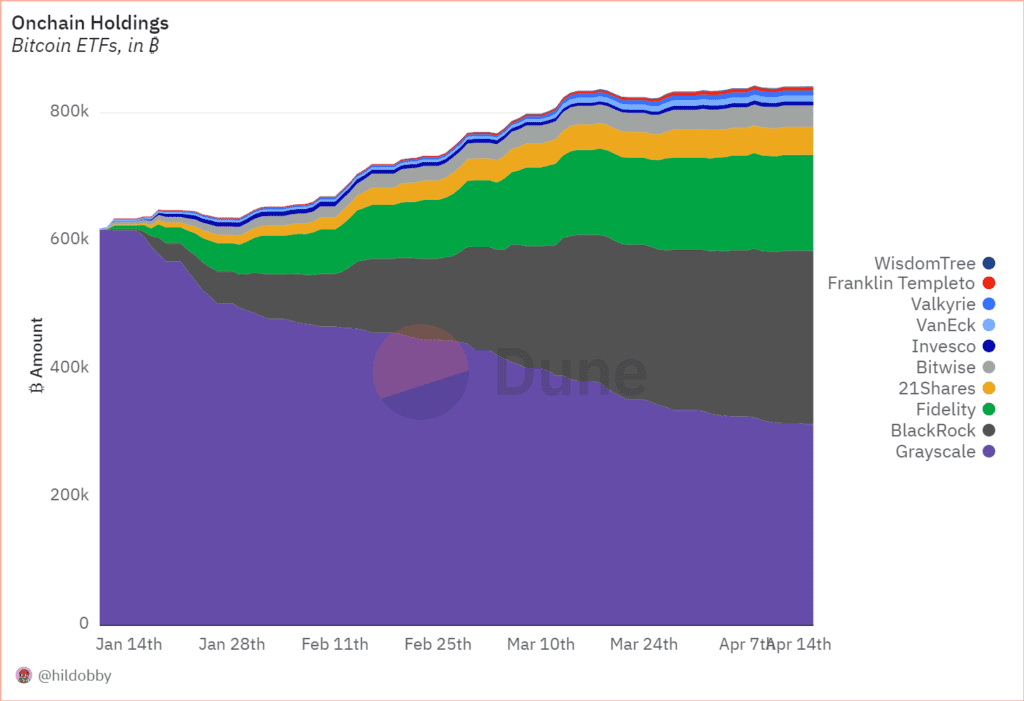

The Bitcoin ETF movement chart exhibits systematic outflow of funds from GBTC and systematic inflows to IBIT and Constancy’s FBTC in latest months.

One of many the reason why many traders choose IBIT over GBTC is as a result of the latter costs a 1.5% annual administration price. In distinction, IBIT and FBTC cost solely 0.25%.

On high of that, BlackRock has a higher popularity because of its standing of the world’s largest investor with $9 trillion in property underneath administration. Additionally, IBIT is likely one of the few Bitcoin ETFs listed on Nasdaq, which is related to tech firms and innovation.

In the meantime, complete Bitcoin ETF quantity has been correcting in April in comparison with document figures in March.

Grayscale Nonetheless Has Largest Chunk of ETF Funds

Regardless of IBIT’s dominance in Bitcoin ETF exercise, Grayscale stays with the biggest shares of Bitcoin ETF AUM, however not for lengthy.

Presently GBTC’s market share is 37% versus IBIT’s 32%, however issues are evolving quickly.

IBIT could proceed to win market share, as BlackRock not too long ago added main US banks as contributors in its Bitcoin ETF product, together with Goldman Sachs, Citigroup, and UBS.

Eric Balchunas of Bloomberg took to X to say:

“BlackRock up to date its bitcoin ETF prospectus w/ many new Approved Contributors incl first-timers Citadel, Goldman Sachs, UBS, Citigroup. Takeaway: huge time companies now need piece of motion and/or at the moment are OK being publicly related w this.”

Bitcoin ETFs are already taking part in a serious function within the crypto business, as they maintain over 4% of Bitcoin’s provide.

Keep up to the mark:

Subscribe to our e-newsletter utilizing this hyperlink – we gained’t spam!

Observe us on X and Telegram.

[ad_2]

Source link